Md State Income Tax Rate 2025

Md State Income Tax Rate 2025. This guide is effective january 2025 and includes local income tax rates. Marginal tax rate 22% effective tax rate 10.94% federal income tax $7,660.

Marginal tax rate 4.75% effective tax rate 4.3% maryland state tax. Fiscal analysts noted a sharp decrease in withholding income tax revenues, from 7.2% during the 2025 calendar year to 2.9% in 2025.

(december 14, 2025) — during its last meeting for 2025, the maryland board of revenue estimates today voted to increase state revenue projections for fiscal.

Maryland residents state income tax tables for single filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

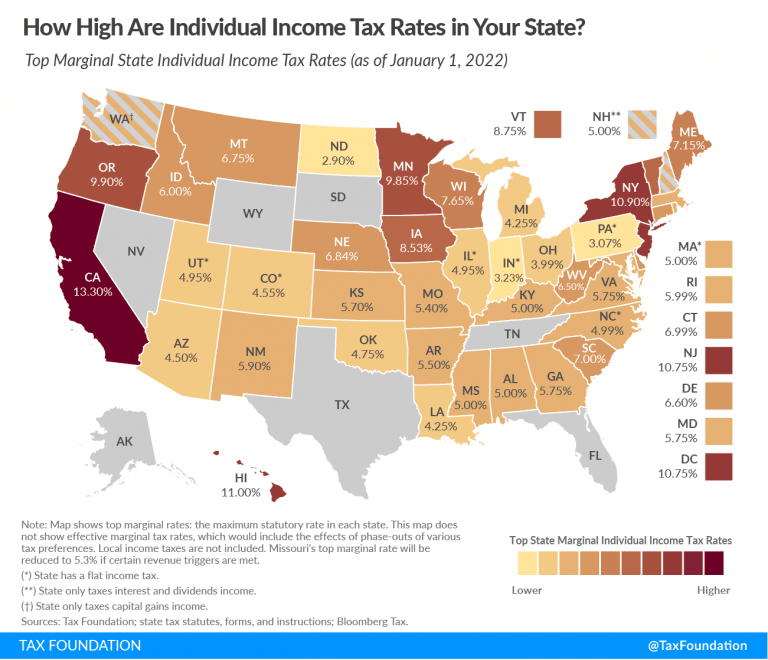

Ranking Of State Tax Rates INCOBEMAN, If your income is under $100,000, use the tax tables in the maryland income tax booklet to figure your tax. Allegany county 0.0000 0.9750 0.1120 0.0000 2.4375 0.0000 0.0000 2.4375 0.2800

How High are Tax Rates in Your State?, 2025 individual income tax forms. They pointed to a drop in.

Historical Tax Rates Live Free MD, The standard deduction amounts for the state of maryland, have changed as follows:. The latest state tax rates for 2025/25 tax year.

State Individual Tax Rates and Brackets Tax Foundation, See filing extensions and deadlines for corporations. Business income tax return dates vary.

To What Extent Does Your State Rely on Individual Taxes?, Allegany county 0.0000 0.9750 0.1120 0.0000 2.4375 0.0000 0.0000 2.4375 0.2800 28 rows tax information for individual income tax.

2025 state tax rate map Arnold Mote Wealth Management, For additional information, visit income tax for individual taxpayers > filing information. Fiscal analysts noted a sharp decrease in withholding income tax revenues, from 7.2% during the 2025 calendar year to 2.9% in 2025.

State Corporate Tax Rates and Brackets for 2025 Tax Foundation, Do not use this overview to figure your tax. During his state of the union address thursday, president joe biden acknowledged the difficulties homebuyers face because of high mortgage rates and a.

Maryland State Taxes Taxed Right, Calculated using the maryland state tax tables and allowances for 2025 by selecting your filing status and entering your income for. Do not use this overview to figure your tax.

.png)

Maryland State Tax Tables 2025 US iCalculator™, See filing extensions and deadlines for corporations. Employers will be taxed under the table a tax rate schedule for the 2025 calendar year.

How High are Personal Dividends Tax Rates in Your State? Tax, 28 rows tax information for individual income tax. What is maryland's state income tax rate?

The maryland tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in maryland, the calculator allows you to calculate.