Irmaa 2025 Income Limits

Irmaa 2025 Income Limits. In 2025, you can earn up to $22,320 without having your social security benefits withheld. The irmaa brackets for 2025.

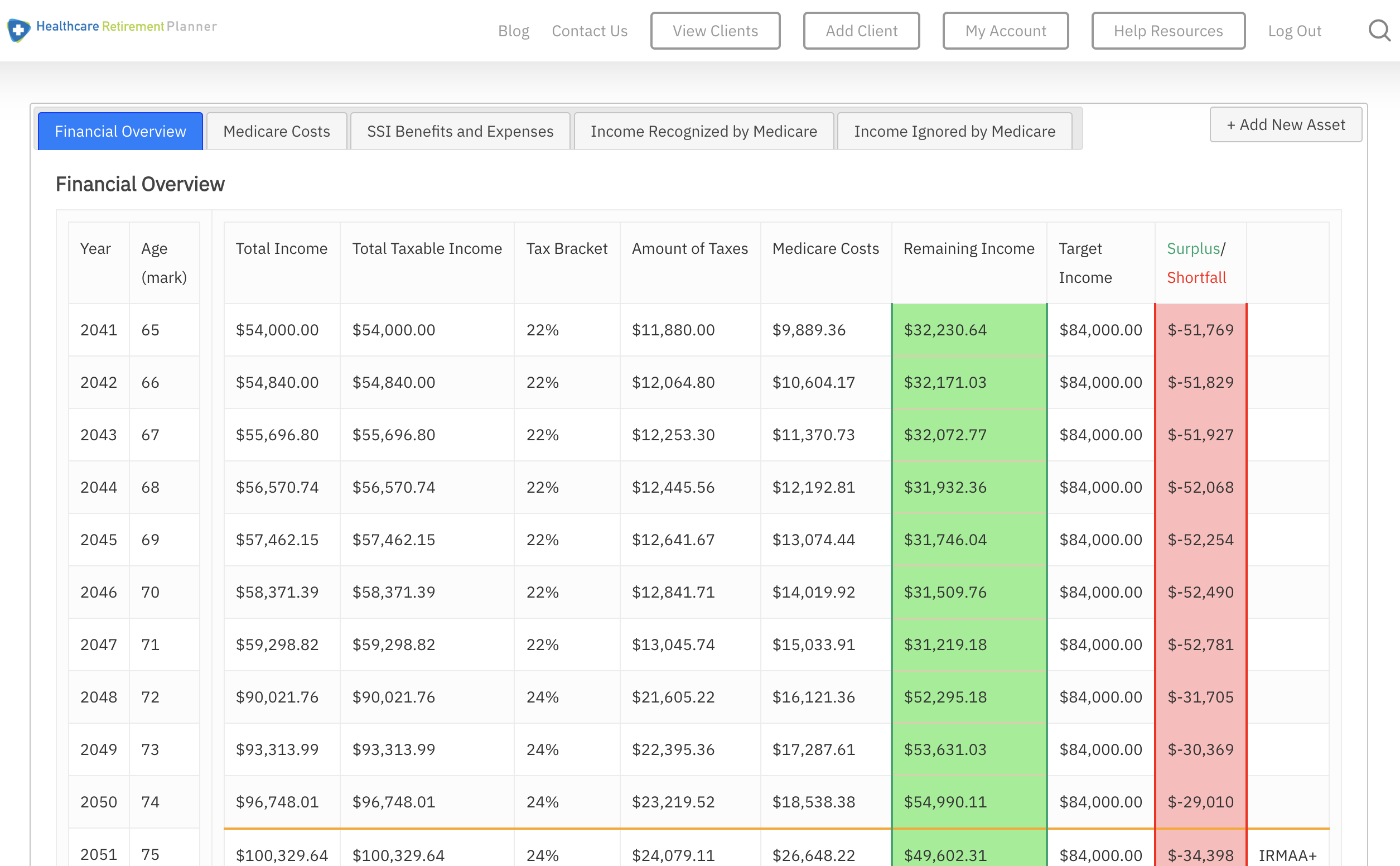

The income on your 2025 irs tax return (filed in 2025) determines the irmaa you pay in 2025. The standard part b premium for 2025 is $164.90 per month.

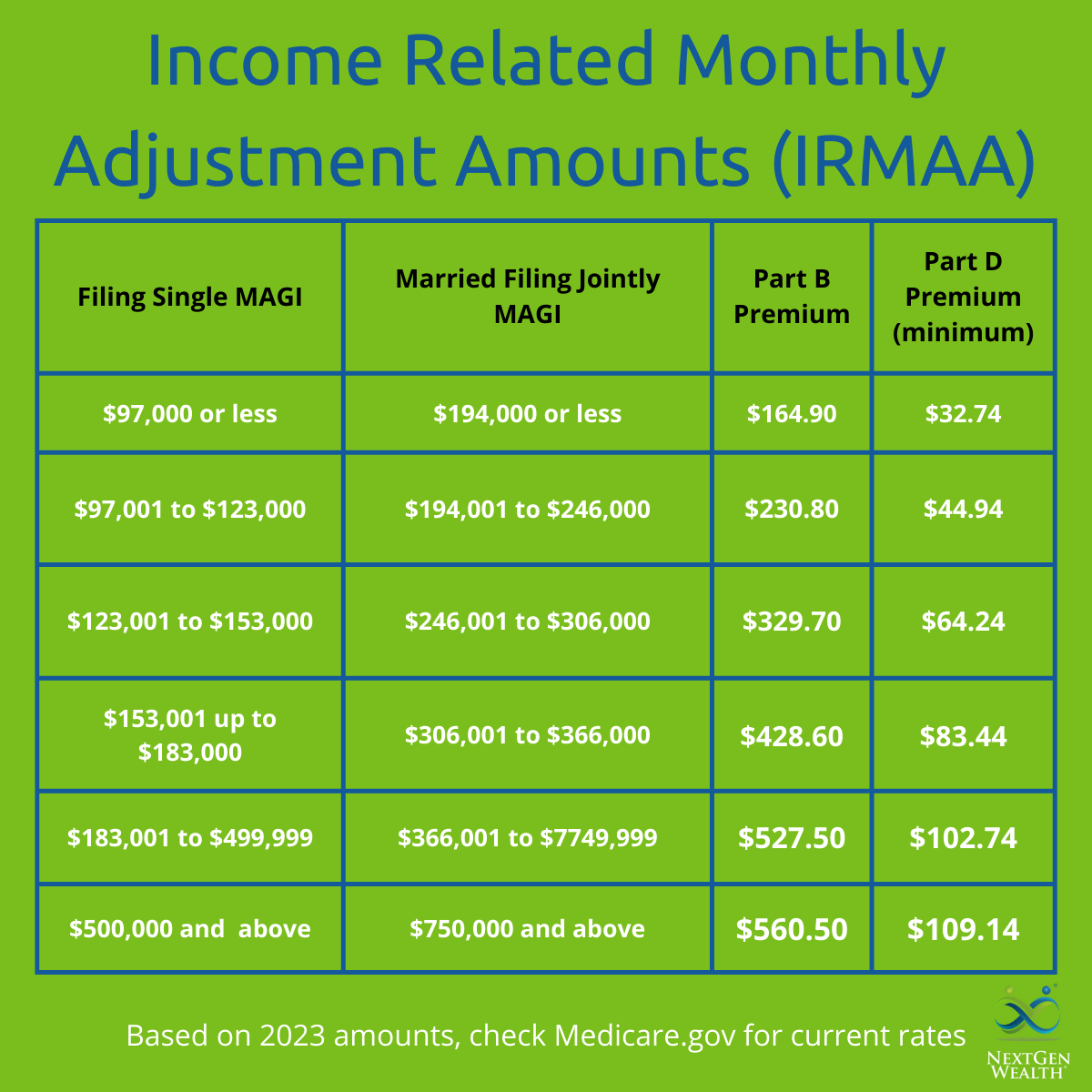

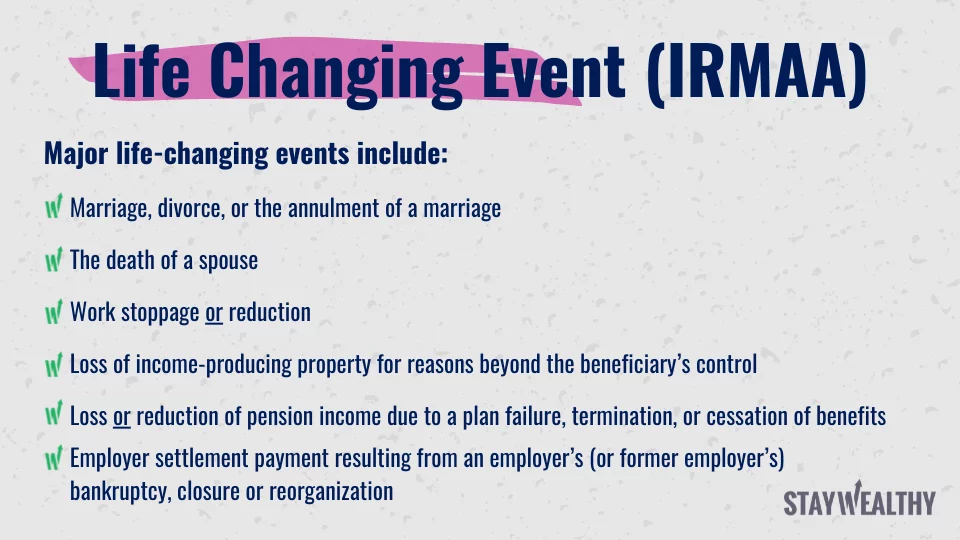

IRMAA Related Monthly Adjustment Amounts Guide to Health, Medicare part b is important to the national health insurance scheme, which covers individuals 65. If you disagree with our decision.

How Much Does Medicare Cost?, What is medicare part b and its income limits. For more helpful information on medicare, check out these frequently asked questions about medicare plans.

Medicare IRMAA 2025 What to Expect for Surcharges in the Coming Year, What is medicare part b and its income limits. Irmaa brackets for 2025 (which use current, 2025 income) :

IRMAA Related Monthly Adjustment Amounts Guide to Health, The irmaa income brackets for 2025 start at $97,000 ($103,000 in 2025) for a single person and $194,000 ($206,000 in 2025) for a married couple. Vat registration and deregistration limits.

Related Monthly Adjustment Amounts (IRMAA) and Medicare Premiums, If you disagree with our decision. The income on your 2025 irs tax return (filed in 2025) determines the irmaa you pay in 2025.

Related Monthly Adjustment Amounts (IRMAA) and Medicare Premiums, New hsa/hdhp limits for 2025 miller. What are the income limits for medicare 2025.

The IRMAA Brackets for 2025 Social Security Genius, The income on your 2025 irs tax return (filed in 2025) determines the irmaa you pay in 2025. Due to both the autumn statement 2025 and spring budget 2025 cuts to national insurance, and changes to the high income child benefit charge, the.

What Are the IRMAA 2025 Brackets (and How to Avoid It!), For example, you would qualify for irmaa in 2025 if your magi from your 2025 tax returns meets the 2025 income thresholds ($103,000 for. As of now we only have 2025 brackets you can find here:

Medicare IRMAA 2025 What to Expect for Surcharges in the Coming Year, Medicare recipients with 2025 incomes exceeding $103,000 (single filers) or $206,000 (married filing jointly) will pay a premium between $244.60 and. If you disagree with our decision.

GMIA, Inc. 2025 Part B Costs and IRMAA Brackets, Is your income for 2025 at or below the limits listed below? Did this answer your question?

For 2025, beneficiaries whose 2025 income exceeded $103,000 (individual return) or $206,000 (joint return) will pay a premium amount ranging from $244.60 to $594,.

The irmaa income brackets for 2025 start at $97,000 ($103,000 in 2025) for a single person and $194,000 ($206,000 in 2025) for a married couple.